What are the medical yarn factories?

Table of Contents:

- Introduction: Navigating the Specialized Landscape of Medical Yarn Manufacturing

- Market Overview: Size, Growth, and Key Drivers

- Understanding Medical Yarn: Types, Materials, and Critical Applications

- Industry Map: Major Players and Regional Specializations (With Data Tables)

- From Yarn to Finished Product: Key Manufacturing Processes and Technologies

- Regulatory Hurdles and Quality Standards: The Non-Negotiable Framework

- Strategic Guide for Procurement and Business Development

- Future Trends: Smart Textiles, Sustainability, and Advanced Materials

- Conclusion: Building a Strategic Sourcing Advantage in Medical Textiles

- FAQ: Addressing Practical Questions for Industry Professionals

1. What are the medical yarn factories? Introduction: Navigating the Specialized Landscape of Medical Yarn Manufacturing

For procurement managers, product developers, and executives across the textile spectrum, the world of medical yarn is a high-stakes, high-value niche that operates under a completely different set of rules compared to conventional apparel or home furnishing textiles. It is an industry defined not just by fiber and twist, but by uncompromising standards of biocompatibility, sterility, and performance under critical conditions. Whether it’s a monofilament suture holding tissue together, a sophisticated knitted mesh for hernia repair, or the elastic yarn in compression garments, medical yarn is the foundational component upon which patient safety and treatment efficacy depend.

This guide serves as a comprehensive roadmap for industry professionals looking to understand, source from, or potentially collaborate with medical yarn factories. We will move beyond a simple directory to explore the market dynamics, technological complexities, stringent regulatory environment, and strategic considerations that define this specialized sector.

2. Market Overview: Size, Growth, and Key Drivers

The medical textiles market, where specialized yarn is a crucial input, is a significant and steadily growing global industry. According to industry research, the global biomedical textiles market was valued at approximately $135 billion (¥966 billion RMB) in 2023, with projections to reach $203 billion (¥1,450 billion RMB) by 2030, representing a compound annual growth rate (CAGR) of 5.9%. The broader hospital-use textiles market and the high-growth segment of medical smart textiles, projected to grow at a remarkable 24.2% CAGR, further underscore the expanding demand for advanced textile components.

Key Market Drivers:

- Aging Global Population: Increasing the prevalence of chronic diseases and surgical procedures.

- Rise of Minimally Invasive Surgeries: Driving demand for advanced implantable meshes and sutures.

- Heightened Focus on Infection Prevention: Boosting need for high-barrier surgical gowns, drapes, and single-use textiles.

- Technological Convergence: Integration of smart sensors, drug-delivery mechanisms, and biocompatible materials into textile structures.

Regional Dynamics:

The market is led by North America, which holds over 30% of the global share, followed by Europe and the Asia-Pacific region, which together account for more than 55%. China is a major and rapidly evolving production and consumption hub within the Asia-Pacific region.

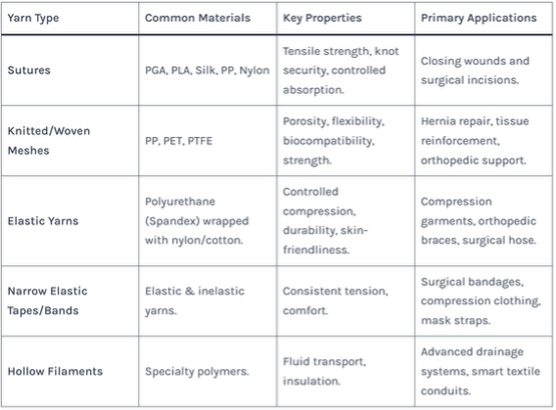

3. Understanding Medical Yarn: Types, Materials, and Critical Applications

Medical yarn is not a single product but a category defined by its end-use. Its properties are meticulously engineered for specific functions.

Primary Material Categories:

- Synthetic Polymers: The workhorses of modern medical textiles.

- Polypropylene (PP), Polyester (PET), Polytetrafluoroethylene (PTFE): Used for non-absorbable sutures, surgical meshes (e.g., for hernia repair), and vascular grafts. Known for high strength and biostability.

- Polylactic Acid (PLA), Polyglycolic Acid (PGA): Bioabsorbable polymers used for sutures and scaffolds that safely dissolve in the body over time.

- Specialty & Natural Fibers:

- Medical-Grade Cotton & Viscose: Used in wound dressings, gauze, and hygiene products for high absorbency and softness. Medical-grade viscose is a key material for products like sanitary nonwovens.

- Collagen & Chitosan: Derived from natural sources, used for advanced wound healing and tissue engineering scaffolds.

- Metal Fibers (e.g., stainless steel): Used in specialized applications like anti-microbial fabrics or radiopaque markers in textiles for X-ray visibility.

Table 1: Medical Yarn Types, Materials, and Primary Applications

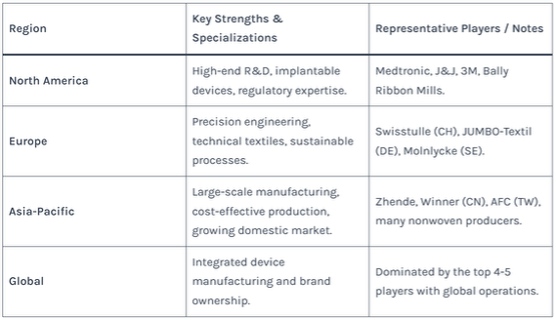

4. Industry Map: Major Players and Regional Specializations

The medical yarn factory ecosystem is layered, comprising global integrated medical device giants, specialized textile manufacturers, and component suppliers.

Global Leaders (Integrated Device Manufacturers):

These companies often produce yarn and fabric for their own finished medical devices. They dominate the market, with the top four players holding over 30% share.

- Medtronic (Covidien): A global leader in surgical sutures and meshes.

- Johnson & Johnson (Ethicon): Renowned for its comprehensive suture and wound closure technologies.

- 3M: A major player in healthcare, supplying materials for tapes, dressings, and filtration.

- Smith & Nephew, B. Braun, Molnlycke, Cardinal Health: Significant players across wound care, surgical products, and hygiene.

Specialized Medical Textile & Yarn Factories:

These are critical partners for brands and OEMs, offering deep technical expertise in specific textile forms.

- Swisstulle AG (Switzerland): A leader in technical knitted fabrics and tulles for implants and pressure textiles.

- Bally Ribbon Mills (USA), JUMBO-Textil (Germany): Experts in engineered narrow fabrics and tapes for medical applications.

- Stretchline, Elastin: Specialists in elastic components for medical and apparel use.

- AFC (Taiwan, China): Produces medical textiles compliant with EN 13795 for surgical gowns and drapes.

- GLYARN , Winner Medical (Mainland China): Leading Chinese manufacturers of wound dressings and disposable medical textiles.

Specialist Material Suppliers:

- Lenzing, Birla Group: Produce medical-grade cellulose fibers like lyocell and viscose used in high-absorbency products.

Table 2: Regional Strengths in the Medical Textile Supply Chain

5. From Yarn to Finished Product: Key Manufacturing Processes and Technologies

Manufacturing medical yarn requires precision and control at every stage, often in certified cleanroom environments.

- Polymer & Fiber Production: Medical-grade polymers are synthesized or sourced with extreme purity. Spinning (melt, dry, or wet) creates filaments with exact denier, tenacity, and cross-sectional shapes.

- Yarn Formation: Filaments may be texturized, combined, or wrapped (e.g., spandex core with nylon sheath) to achieve specific elasticity or handling characteristics. For nonwovens, fibers are directly formed into webs via processes like spunlace (hydroentanglement), as seen with companies like JiangSu FangJing New Material which uses waterjet technology to create biodegradable fabrics.

- Fabric Formation:

- Weaving/Knitting: For meshes and implants, done on high-precision looms and knitting machines (e.g., from Picanol or Jakob Müller).

- Nonwoven Production: Dominant for disposable products (gowns, drapes, wipes). Key technologies include spunbond-meltblown-spunbond (SMS) and hydroentanglement.

- Finishing & Conversion: This includes bleaching, dyeing (with approved colorants), coating (e.g., with antimicrobial agents), cutting, sewing, and sterilization (using ethylene oxide, gamma radiation, or steam).

6. Regulatory Hurdles and Quality Standards: The Non-Negotiable Framework

This is the single most critical differentiator from conventional textiles. Medical yarn factories operate under strict quality management systems.

- Quality Management System (QMS): ISO 13485 is the international standard specific for medical devices, mandatory for any serious supplier.

- Product Standards: Regulations vary by region but are stringent.

- United States: Regulation by the Food and Drug Administration (FDA). Products are classified (I, II, III) based on risk, requiring pre-market notification [510(k)] or Premarket Approval (PMA).

- European Union: Must comply with the Medical Device Regulation (MDR), requiring a CE mark.

- Other Standards: EN 13795 specifies requirements for surgical gowns, drapes, and clean air suits. AAMI PB70 classifies the barrier performance of protective apparel.

- Biocompatibility Testing: Following ISO 10993, materials must be tested to ensure they do not elicit toxic, irritant, or allergic reactions when in contact with the body.

7. Strategic Guide for Procurement and Business Development

For procurement managers and business developers, engaging with this sector requires a strategic approach.

- Define Requirements Precisely: Is the need for a finished medical device (suture, mesh) or a component material (yarn, fabric)? The former leads to integrated device makers; the latter to specialized factories.

- Conduct Rigorous Supplier Qualification: Audit potential factories for ISO 13485 certification, regulatory history (FDA inspections, CE mark), and cleanroom capabilities. Don’t just assess price.

- Understand the Total Cost of Compliance: The cost includes not just the material, but also documentation, validation testing, and regulatory submission support. A cheaper yarn from an unqualified supplier carries immense risk.

- Consider Partnerships: For innovative projects (e.g., smart textiles), partnering with a factory that has R&D expertise, like those developing AI-powered textile inspection systems or smart care garments, can be crucial.

8. Future Trends: Smart Textiles, Sustainability, and Advanced Materials

- Smart Medical Textiles: Integration of sensors for monitoring vital signs (e.g., heart rate, pressure), drug delivery systems, and therapeutic functions (like temperature regulation). Companies like AiQ Smart Clothing and Hexoskin are active in this space.

- Sustainability & Circularity: Driven by environmental concerns and potential regulations. Focus on biodegradable polymers (like PLA), recyclable materials, and developing compostable or flushable nonwovens from materials like lyocell and pulp.

- Advanced Biomaterials: Development of yarns from human-like collagen, chitosan from shellfish, and other biomimetic materials to improve tissue integration and healing.

- Advanced Manufacturing: Adoption of AI and machine vision for 100% defect detection in production, and additive manufacturing (3D printing) for creating patient-specific textile implants.

9. Conclusion: Building a Strategic Sourcing Advantage in Medical Textiles

Navigating the landscape of medical yarn factories requires shifting from a commodity purchasing mindset to one of strategic partnership and technical due diligence. Success lies in understanding the layered market structure—from global giants to niche specialists—and recognizing that quality, regulatory compliance, and traceability are not value-adds but the absolute baseline. By aligning with qualified partners, staying abreast of material innovations like smart textiles and sustainable biomaterials, and rigorously validating the supply chain, businesses can secure a reliable source of critical components. This diligence not only mitigates risk but also positions companies to leverage textile-based innovations that are reshaping the future of healthcare.

10. FAQ: Addressing Practical Questions for Industry Professionals

Q1: As an apparel manufacturer, can we easily switch some production lines to make medical yarn or fabric?

A: Not easily. While the core textile machinery may be similar, the transition is profound. It requires investment in cleanroom facilities, implementing a ISO 13485 quality system, using medically certified raw materials, and navigating complex regulatory approvals (FDA, MDR). The cost and time barriers are significant. Partnership or acquisition is a more common path.

Q2: What’s the main difference between a “medical-grade” yarn and a regular textile yarn?

A: The difference is rooted in guarantees and documentation. Medical-grade yarn is produced under a controlled QMS (ISO 13485), from raw materials with known and tested biocompatibility (per ISO 10993). Its entire production history is traceable. A regular yarn may be chemically identical, but it lacks the rigorous validation, testing, and documentation required to prove its safety for human implantation or prolonged medical contact.

Q3: Are there “off-the-shelf” medical yarns we can buy for product development?

A: For true implantable or critical care applications, no. These yarns are part of a validated device system. For non-critical applications (e.g., some external support garments), some specialized yarn suppliers may offer products with certain certifications. However, the finished product manufacturer is ultimately responsible for validating the entire material chain for its specific intended use and regulatory submission.

Q4: How important is geographic location when choosing a medical yarn factory?

A: It is a strategic consideration. Proximity can ease audit schedules, logistics, and communication. Regulatory familiarity is key—a factory experienced with FDA expectations is vital for the US market, just as one skilled in MDR compliance is for Europe. China offers scale and cost advantages but requires diligent supply chain oversight. Many companies opt for a diversified supplier base across regions.

Q5: We produce high-quality technical textiles for automotive/industrial use. Is medical a logical diversification?

A: It can be, as you possess engineering and precision manufacturing expertise. However, the regulatory leap is the primary challenge. The focus must shift from physical performance to biological safety and documentary traceability. A targeted strategy, starting with lower-risk Class I medical devices (like some general hospital textiles) and investing in the necessary QMS, is a prudent first step.

Q6: What are the biggest cost drivers in medical yarn production?

A: 1. Compliance Costs: Maintaining QMS, conducting biocompatibility/performance testing, and regulatory submissions. 2. Specialized Materials: USP-classified polymers, high-purity additives. 3. Controlled Environment: Cleanroom operation and monitoring. 4. Sterilization: Validated sterilization processes and associated logistics.

Q7: How long does it typically take to qualify a new medical yarn supplier?

A: The timeline is substantial, often 12 to 24 months or more. It involves initial audits, technical agreement negotiation, sample production, full battery of testing (biological, mechanical, shelf-life), process validation at the factory, and finally, inclusion in your own regulatory submission to authorities like the FDA, which itself can take many months for review.